Overview

Navigating health insurance for diabetes care involves understanding key concepts like premiums, deductibles, and coverage for essential supplies, which are crucial for effective management of the condition. The article emphasizes that by comprehending these terms and utilizing available resources, such as the American Diabetes Association and state assistance programs, individuals can make informed choices to secure the necessary support for managing their diabetes effectively.

Introduction

Navigating the complexities of health insurance is a crucial aspect of effective diabetes management. With the rising costs of care and medications, understanding the fundamentals of health insurance can empower individuals to make informed decisions that directly impact their health outcomes. This article delves into essential concepts such as:

- Premiums

- Deductibles

- Coverage specifics

Providing clarity on how these elements affect access to necessary diabetes care. Additionally, it explores available resources and rights under the Affordable Care Act, ensuring individuals are well-equipped to advocate for their health needs. By grasping these critical aspects, patients can better navigate their options and secure the support required for managing diabetes effectively.

Understanding Health Insurance Basics for Diabetes Care

Health coverage, such as the American Diabetes Association health insurance, plays a vital role in influencing the quality of care for individuals managing blood sugar conditions. A clear understanding of key terms—such as ‘premium’, ‘deductible’, ‘copayment’, and ‘out-of-pocket maximum’—is essential for effective diabetes management. Here are significant aspects to consider:

- Premium: This represents the monthly payment required for your health coverage. Selecting a plan with a premium that aligns with your budget is vital to ensure consistent access to necessary care.

- Deductible: This is the out-of-pocket expense you must incur before your insurance begins to pay for covered services. For individuals with this condition, knowing the deductible amount is crucial, as it directly affects when and how you can access medical benefits.

- Copayment: This refers to the fixed charge you pay for specific medical services or medications once your deductible has been met. Comprehending this cost enables improved planning of healthcare expenses associated with managing blood sugar conditions.

- Out-of-Pocket Maximum: This is the cap on total annual expenses for covered services. Upon reaching this limit, your coverage will take care of 100% of associated costs for the remainder of the year, providing financial relief for extensive medical needs.

- Coverage for Essential Supplies: Most health insurance plans are mandated to cover necessary products for managing diabetes, including insulin, blood glucose monitors, and test strips. It is crucial to become acquainted with the details of what provisions are included in your plan and any related expenses.

Recent legislation, such as West Virginia SB 577, requires a maximum of $35 for a 30-day supply of insulin, demonstrating an increasing awareness of the necessity for affordable health management. However, coverage for GLP-1 medications, which have seen a significant rise in prescription volume—up to 500% from 2019 to 2022—remains controversial. According to Milliman, Medicaid spending in 2022 due to GLP-1 drugs was $4.1 billion, and only 25% of large employers provide coverage for these drugs aimed at weight loss.

This emphasizes the ongoing discussion regarding the implications of these medications for managing blood sugar. Moreover, revisions like Ohio’s policy permitting pharmacists to provide a seven-day supply of medications for chronic conditions demonstrate continuous changes in healthcare accessibility and their influence on managing chronic illnesses.

By thoroughly grasping these essential coverage concepts, individuals overseeing their condition can make informed choices regarding their medical coverage plans, including options like American Diabetes Association health insurance, ensuring they obtain the necessary assistance for effective management.

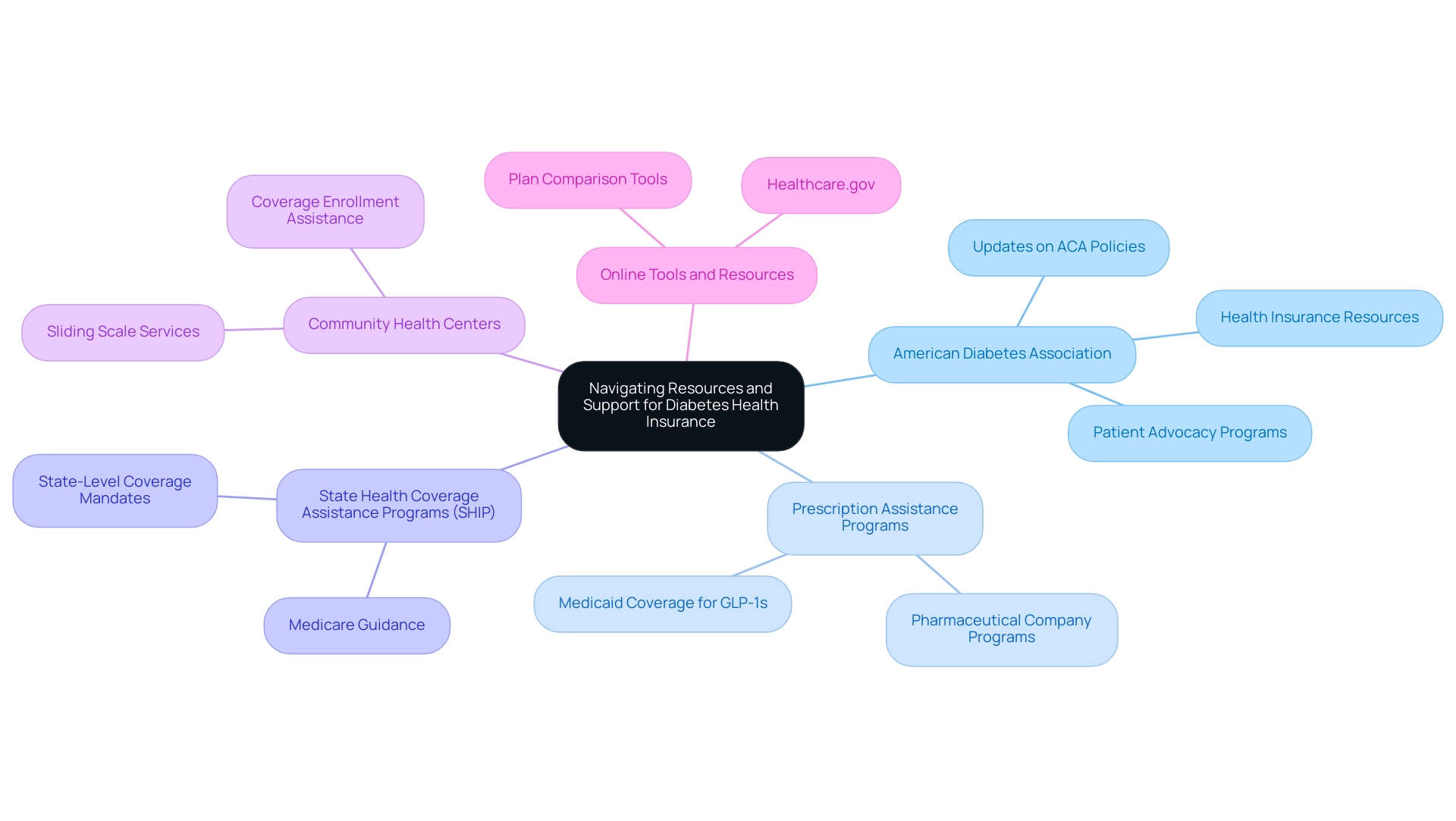

Navigating Resources and Support for Diabetes Health Insurance

Navigating the intricacies of medical coverage for managing blood sugar conditions can be difficult, but many resources are accessible to help you:

-

The American Diabetes Association (ADA) serves as a foundation for individuals looking for assistance in managing their condition and understanding their American Diabetes Association health insurance. They provide a comprehensive array of resources, including the latest updates on health insurance policies and patient advocacy programs from the American Diabetes Association health insurance, ensuring that individuals are informed about their rights and options under the Affordable Care Act (ACA). Recent insights from the American Diabetes Association Health Insurance emphasize the importance of these resources in promoting access to essential care for those with diabetes.

- Prescription Assistance Programs: Prescription costs can be a significant burden for those managing their condition. Many pharmaceutical companies offer prescription assistance programs designed to alleviate financial challenges for individuals struggling to afford their medications. As highlighted by KFF, 13 states under Medicaid fee-for-service contracts cover GLP-1s for obesity treatment, which underscores the importance of these programs in supporting management of blood sugar. It is advisable to check with the manufacturers of your blood sugar medications to explore the availability of these programs, which have seen a notable increase in participation over recent years.

- State Health Coverage Assistance Programs (SHIP): SHIP offers complimentary, impartial guidance on coverage options, simplifying the process for patients to comprehend their selections. These programs are particularly beneficial for those eligible for Medicare, as they offer tailored support to navigate the complexities of Medicare benefits. Moreover, state-level coverage mandates require state-regulated care plans to include specific benefits related to blood sugar management, improving access to essential resources for treatment.

- Community Health Centers: These centers often operate on a sliding scale, making care for blood sugar management more accessible and affordable. Alongside their medical services, community wellness centers can aid with coverage enrollment and offer referrals to specialists, ensuring thorough support for managing blood sugar conditions.

- Online Tools and Resources: Websites like Healthcare.gov serve as valuable platforms for individuals seeking information on medical coverage options, enrollment periods, and details. Utilizing these tools enables patients to compare plans effectively and select one that best meets their care needs for managing blood sugar. Significantly, a recent study emphasized that Medicaid expenditure on GLP-1 medications hit $4.1 billion in 2022, indicating the growing dependence on these treatments for managing blood sugar levels.

By utilizing these various resources, individuals can navigate their coverage options more effectively and obtain the essential support for controlling their blood sugar.

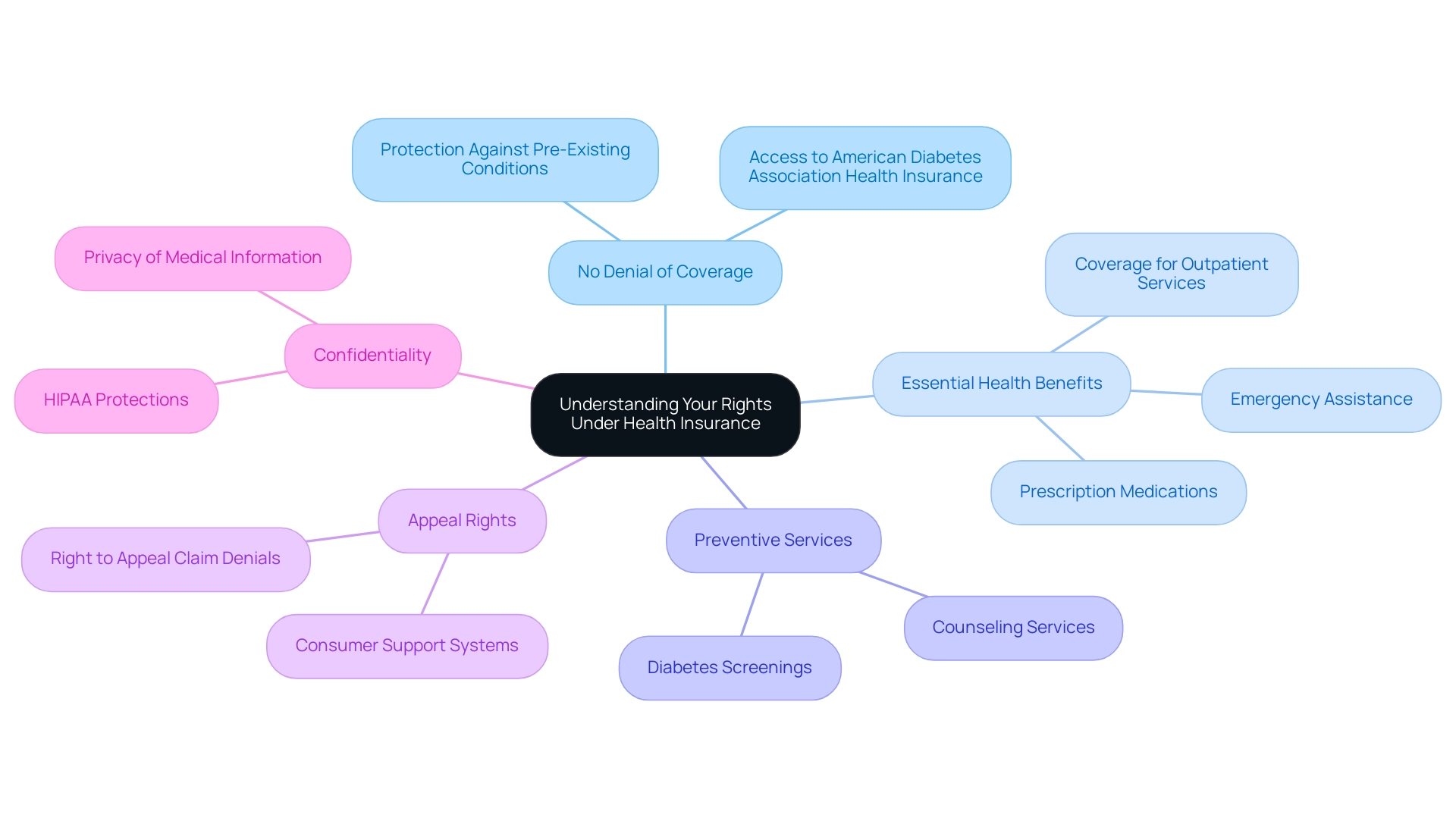

Understanding Your Rights Under Health Insurance

Under the Affordable Care Act (ACA), individuals living with the condition are afforded critical protections against discrimination and specific rights concerning their American Diabetes Association health insurance coverage. Understanding these rights is essential for effective diabetes management:

- No Denial of Coverage: Insurers are prohibited from denying coverage based on pre-existing conditions, including diabetes. This guarantees that individuals can acquire American Diabetes Association health insurance, regardless of their condition, promoting access to essential services.

- Essential Health Benefits: Health plans are required to cover essential health benefits that include outpatient services, emergency assistance, and prescription medications. It is crucial to familiarize yourself with the benefits of the American Diabetes Association health insurance plan to ensure comprehensive care is accessible.

- Preventive Services: Health insurance must provide coverage for preventive services without imposing copayments or coinsurance. This includes diabetes screenings and counseling, which are vital for early detection and effective management of the condition, as emphasized by the American Diabetes Association health insurance.

- Appeal Rights: In the event of a claim denial, individuals possess the right to appeal the decision. A thorough understanding of the appeals process is essential for advocating effectively for your well-being and ensuring access to necessary treatments.

- Confidentiality: Medical information is safeguarded under the Health Insurance Portability and Accountability Act (HIPAA), which ensures the privacy of medical care decisions. This legal framework is pivotal for maintaining the confidentiality of personal health information.

Moreover, it is important to acknowledge the financial challenges faced by individuals with this condition, especially concerning American Diabetes Association health insurance. According to recent statistics, low-income patients encounter a median unpaid claim of $412, while high-income patients face a median of $365. This highlights the need for robust protections under the ACA, including the American Diabetes Association health insurance, to mitigate these financial burdens.

As mentioned in a recent New York Times article, patients reported that denials of treatment led to lost vision, paralysis, and death, emphasizing the real-world implications of understanding your rights under the ACA.

Furthermore, the ACA’s influence reaches beyond support for blood sugar management. For instance, the case study titled “Impact of the ACA on Children with Pre-Existing Conditions” illustrates how the ACA prohibits insurers from denying coverage to children under 19 based on pre-existing conditions. This protection has enabled many children to access essential medical services that were previously unreachable.

By thoroughly grasping these rights, individuals can explore their coverage options with increased assurance, guaranteeing they obtain the essential support for managing their condition effectively. This knowledge is especially vital as the Current Population Survey reveals a 10.9% uninsured rate among U.S. adults aged 19–64, highlighting the necessity for awareness and advocacy in care access.

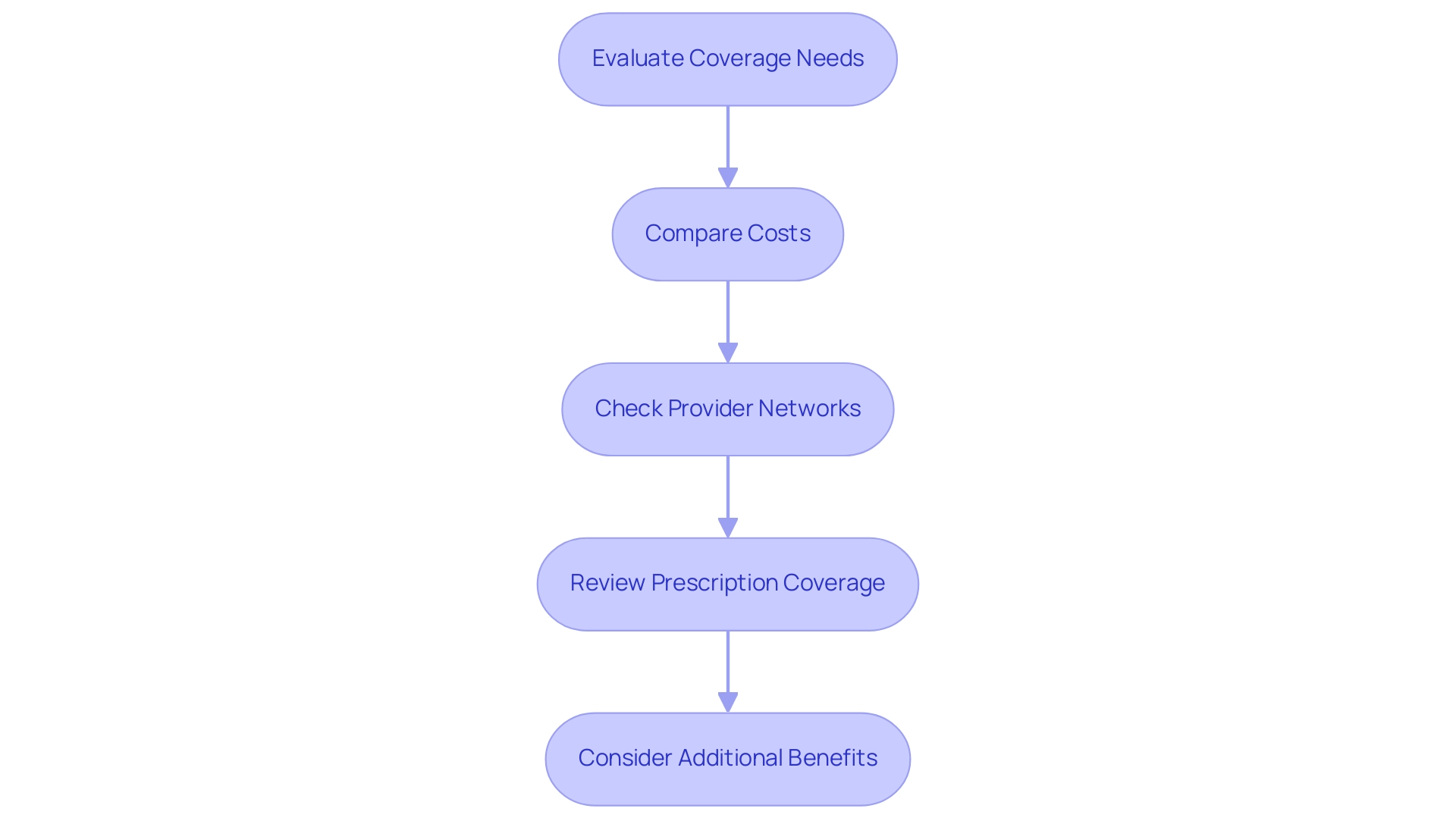

Tips for Choosing the Right Health Insurance Plan

Selecting a suitable plan, such as American Diabetes Association health insurance, is essential for efficient management of the condition, requiring a comprehensive assessment of individual healthcare needs. Here are essential tips to assist in your decision-making process:

-

Evaluate Coverage Needs: Begin by assessing your specific health management requirements, encompassing medications, regular doctor visits, and necessary supplies.

It is vital to ensure that the American Diabetes Association health insurance plan provides adequate coverage for these essentials. -

Compare Costs: Consider the total cost of care by looking beyond the monthly premium. Analyze deductibles, copayments, and out-of-pocket maximums, and calculate your potential annual expenses based on your anticipated healthcare usage.

The financial burden of managing the condition is significant, with direct medical costs projected to rise by 35% from previous estimates, underscoring the importance of evaluating options like American Diabetes Association health insurance in your decision-making. -

Check Provider Networks: Verify that your preferred healthcare providers and specialists are included in the plan’s network. Using in-network services can greatly lower out-of-pocket expenses, which is vital considering that uninsured adults with diabetes have a higher probability (35.7%) of not following prescribed medication due to financial limitations, in contrast to those with private insurance, as highlighted by the American Diabetes Association health insurance recommendations.

This statistic emphasizes the significance of choosing a plan that promotes medication adherence to manage the condition effectively, as recommended by the American Diabetes Association health insurance. -

Review Prescription Coverage: Confirm that your blood sugar medications are included in the plan’s formulary, and evaluate the associated costs. Understanding the out-of-pocket expenses for medications is essential, particularly when considering the American Diabetes Association health insurance, as average costs are expected to increase in 2024.

This is particularly relevant given the overall increasing expenses related to managing blood sugar. -

Consider Additional Benefits: Some insurance plans offer enhanced benefits such as wellness programs and education classes for managing blood sugar, which can play a pivotal role in managing the condition effectively. These additional resources can provide significant value and support your overall health management strategy, especially when considering American Diabetes Association health insurance.

Moreover, reviewing case studies, like those focusing on hospice expenses related to diabetes-related issues, highlights the financial consequences of this condition and the need for economical treatment strategies.

By following these guidelines, individuals can make informed choices that correspond with their healthcare requirements and financial circumstances, ultimately aiding in effective management of this health condition with the support of American Diabetes Association health insurance.

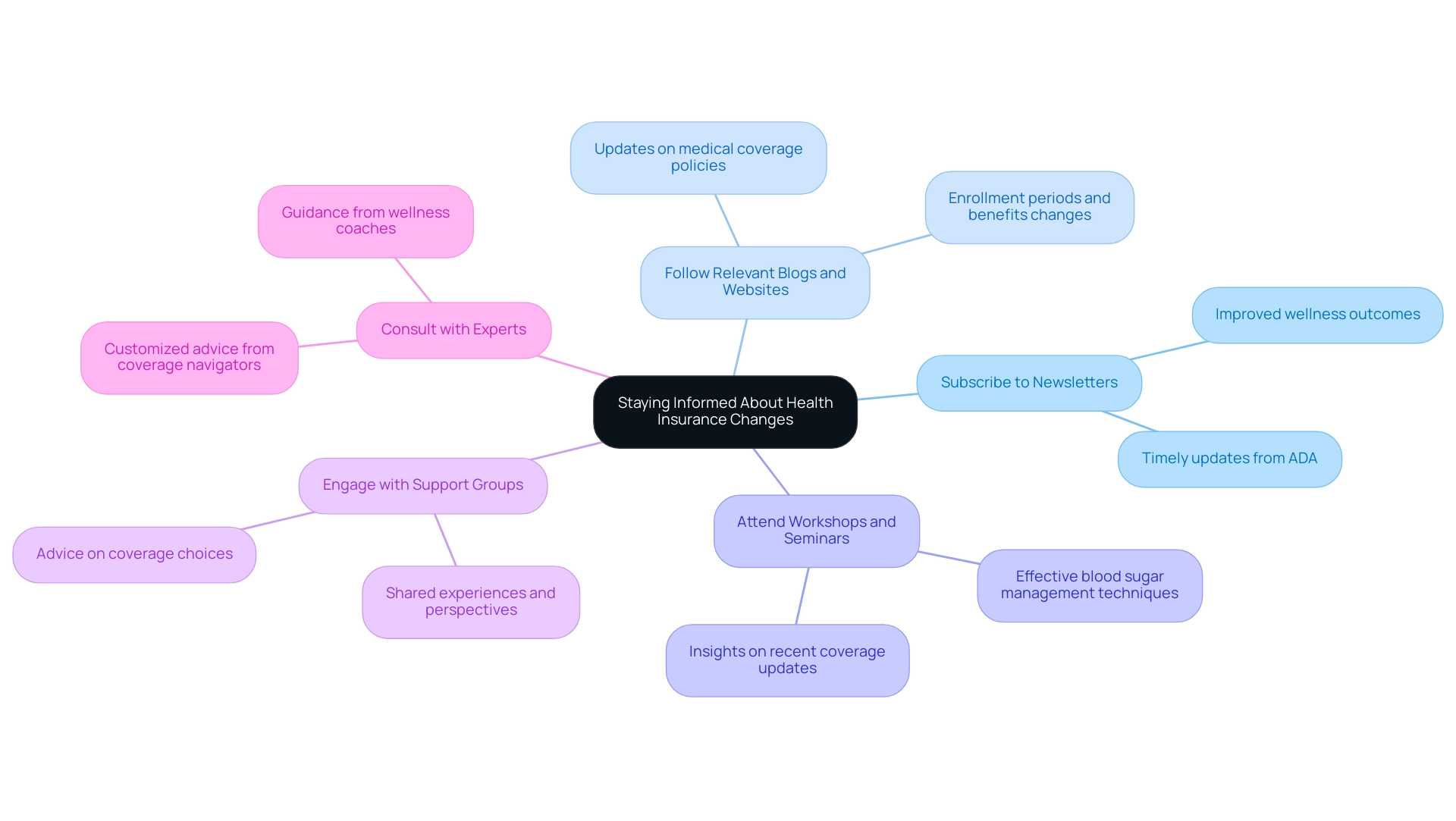

Staying Informed About Health Insurance Changes

Health coverage plans and regulations are subject to frequent changes, which can significantly affect coverage options and associated costs for individuals with blood sugar issues. To navigate these complexities effectively, consider the following strategies:

-

Subscribe to Newsletters: Regularly enroll in newsletters from the American Diabetes Association (ADA) and other reputable organizations that provide timely updates on health insurance coverage alterations relevant to managing blood sugar conditions.

This is essential as coverage with ample provisions for management tools related to medical conditions is linked to improved wellness results.

-

Follow Relevant Blogs and Websites: Utilize resources such as Healthcare.gov, which provides crucial updates on medical coverage policies, enrollment periods, and changes to benefits that affect management of blood sugar conditions.

-

Attend Workshops and Seminars: Participate in educational workshops and seminars that are organized by the American Diabetes Association health insurance or local wellness organizations.

These occurrences can offer important perspectives on recent medical coverage updates and efficient blood sugar management techniques.

-

Engage with Support Groups: Actively participate in support groups for individuals with chronic conditions, both online and in-person.

These communities can provide collective experiences and important perspectives regarding coverage choices and care alternatives.

-

Consult with Experts: If you have particular questions about your medical coverage, it might be helpful to seek advice from a coverage navigator or a wellness coach specializing in diabetes.

These experts can provide customized advice suited to your requirements.

By using these methods, individuals can stay knowledgeable about their coverage choices. This proactive approach is crucial, especially given that nearly 48% of adults with medical debt face significant financial burdens. Additionally, the case studies show slight variations in uninsured rates, with the National Health Interview Survey reporting an uninsured rate of 10.8% compared to 10.9% from the Current Population Survey.

Moreover, as highlighted by Sarah S. Casagrande, PhD, the American Diabetes Association health insurance has considerably enhanced medical coverage for adults with blood sugar issues after the implementation of the Affordable Care Act in 2010. Staying updated is essential for making necessary adjustments to diabetes care plans, particularly as we move into 2024, when further changes to health insurance policies are anticipated that could impact coverage for diabetes management tools.

Conclusion

Navigating health insurance is a vital component of effective diabetes management, and understanding its key elements can significantly enhance access to necessary care. This article highlighted essential concepts such as:

- Premiums

- Deductibles

- Copayments

- Out-of-pocket maximums

All of which play a crucial role in determining the financial landscape of diabetes care. Additionally, it emphasized the importance of knowing coverage specifics, particularly regarding diabetes supplies and medications, to ensure that individuals can advocate for their health needs effectively.

Moreover, the resources available to individuals managing diabetes were outlined, including support from organizations like:

- The American Diabetes Association

- Prescription assistance programs

- Community health centers

These resources provide crucial guidance and financial assistance, making it easier for patients to navigate the complexities of health insurance. Understanding rights under the Affordable Care Act further empowers individuals to secure their health coverage and access necessary care without discrimination.

Choosing the right health insurance plan requires careful consideration of personal healthcare needs, costs, and available benefits. By evaluating these factors and staying informed about changes in health insurance policies, individuals can make well-informed decisions that align with their diabetes management goals. Ultimately, a proactive approach to understanding health insurance not only facilitates better access to care but also supports improved health outcomes for those living with diabetes.